New Child Protection Laws – By Jessica Greene

- Limits to when a child will be reunified with a parent;

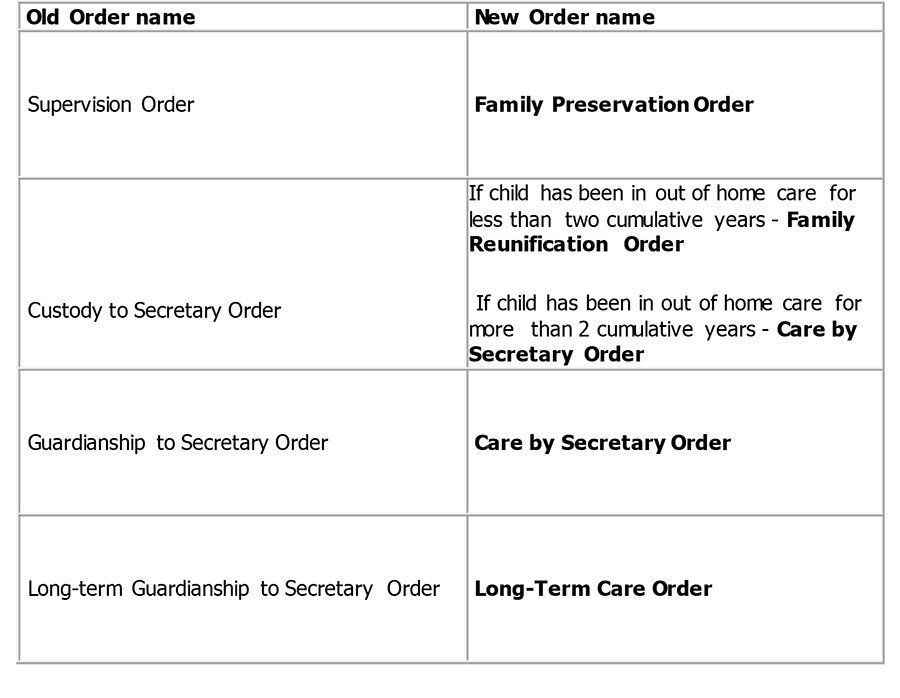

- Changes to the names of Protection Orders; and

- Changes to conditions that may be included on orders

As of 1 March 2016, if a child is subject to any of these orders, the name of that order will have been changed:

Some orders already existing as at 1 March 2016 will remain until they expire. Some, such as Custody to Secretary Order, automatically converted to a Family Reunification Order.

- it is satisfied that there is compelling evidence that it is likely that parent of the child will permanently resume care of the child during the period of the extension;and

- the extension will not have the effect that the child will be placed in out of home care for a cumulative period that exceeds two years.

- a decision for non-reunification to parental care;

- a decision which relates to your contact with your child; and/or

- a decision about where your child should live